Are you looking to buy or sell in cottage country? I am Brad Sinclair, a dedicated Real Estate Sales Specialist with Re/Max Professionals North. As a strategic marketer and expert problem solver, I specialize in navigating the rural and waterfront markets of the Kawarthas, Peterborough, and Haliburton areas. We are the leading authority in this region. We don't just list homes; we look to earn your business by bringing you deep local knowledge, fierce representation, and unmatched service.

Monday, December 15, 2025

Monday, July 14, 2025

Case Study: Walk away from a deal because of the deposit amount?

When Deposit Demands Derail Real Estate Deals

Here is a recent case study that happened to me and some of the everyday complexities and challenges in real estate transactions. The key points are:

- The buyers found a house in rough shape that had been on the market for 2 years, presenting an opportunity for sweat equity.

- The initial offer was over 90% of the asking price, with a $10,000 deposit and a quick 45-day closing timeline - a very strong offer.

- The seller countered, asking for a higher $25,000 deposit, citing it as "standard" for a 5% deposit.

- We argued that the $10,000 deposit was appropriate given the buyers' financial situation and the limited risk to the seller with the quick closing timeline. However, the seller insisted on the higher $25,000 deposit.

- Ultimately, the deal fell through, as the seller was overly focused on maximizing the deposit rather than working constructively with the qualified buyers.

This case study illustrates how a seller's inflexibility around deposit amounts, even when a buyer is making a very strong offer, can derail an otherwise viable transaction. A $10,000 deposit on a home under $1 million is already a substantial amount that demonstrates the buyers' commitment. Pushing for an even higher $25,000 deposit, without a clear justification, seems unreasonable and could cost the seller a sale.

A common question is how much deposit is standard on a real estate contract? The simple answer is that there is no simple answer. The deposit money is a term of the contract agreed upon between the buyer and the seller. The more deposit money put forward, the more security the seller gains once the conditions have been met. The deposit money forms part of the purchase price and is calculated as part of the total price offered and not in addition to it.

For sellers, the deposit serves as a security measure that provides peace of mind. A buyer who submits a large deposit demonstrates a strong commitment to the deal. This is an excellent thing in a multiple offer situation. This good-faith money acts as a safeguard, ensuring that the seller won't be left in the lurch if the buyer backs out without a valid reason.

So in my case, the seller wanted a $25,000 security measure for a closing that would happen in 45 days. He felt that $10,000 was insufficient to enforce the closing, as it was such a small amount that the buyers might be willing to walk away if they changed their minds. I don't know how many people who are buying houses under $1 million don't think $10,000 is a lot of money. The only common reason why anybody would walk away from their deposit in a real estate deal that I can think of is if values drastically changed. The bottom dropped out of the market. The risk of that happening in 45 days is extremely low. Is it worth walking away from a deal altogether because of that fear?

**Update** The listing that turned us down is still listed for sale. My buyer found another property, placed an offer and closed.

Thursday, May 29, 2025

Capital Gains, how much do I pay and how is it calculated? Find out here all about Capital Gains.

Capital Gains explained without putting you to sleep

Ahhhh, good old Capital Gains.

Let’s dive into the topic of what exactly capital gains are and why they matter for real estate investors and homeowners.

Capital gains are the profits you make when you sell an asset, like a house or investment property, for more than you originally paid for it. This "gain" in the asset's value is considered taxable income by the government. The capital gains tax rate is calculated based on your tax rate for regular income.

One key exception is that capital gains taxes generally don't apply to the sale of your primary residence, as long as you've lived there for at least 2 of the last 5 years. This can make it a powerful wealth-building tool for homeowners.

So, how much will you actually pay in capital gains taxes? Your accountant, not your realtor, is best suited to answer that. But I can give you a rough example calculation to understand the basics:

Let's say you sell an investment property for $100,000 more than you originally paid for it. You'd be taxed on 50% of that $100,000 gain, which is $50,000. If you're in the 33% tax bracket, that would result in $16,500 in capital gains taxes owed. The remaining $83,500 would be yours to keep.

There are online capital gains calculators that can give you a quick estimate before talking to your accountant. And remember, as they say, the only two certainties in life are death and taxes - including capital gains taxes when you make money on an investment.

In summary, capital gains are a crucial aspect of real estate investing and homeownership that you should understand. Knowing how they work can help you plan your finances and maximize your returns. Please let me know if you have any other questions.

Brought to you by: Your local Realtor®

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

Not intended to solicit clients under contract

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

Not intended to solicit clients under contract

Wednesday, May 21, 2025

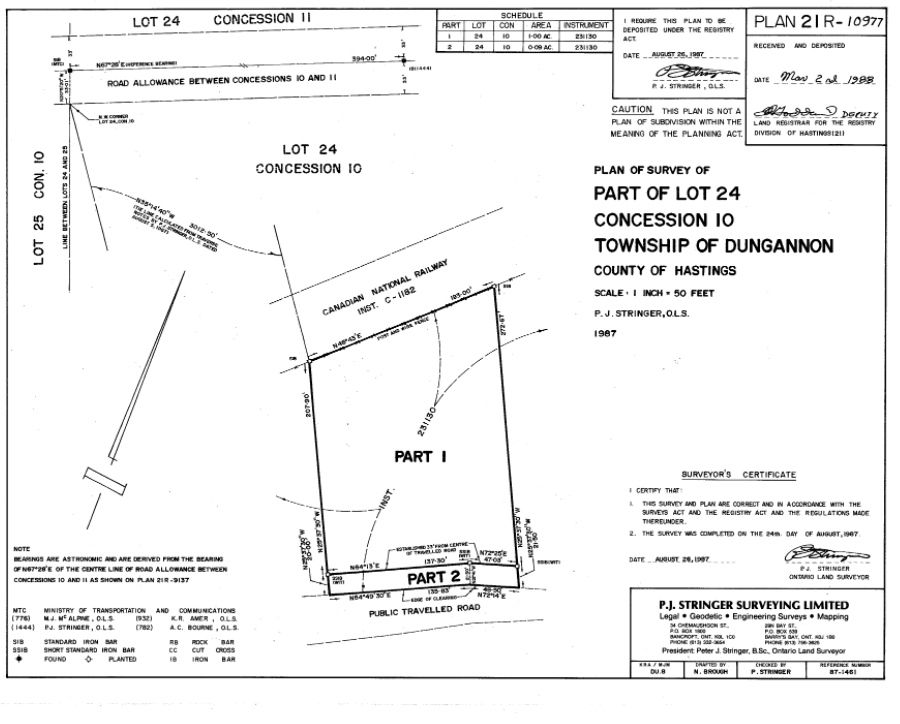

How to Read a Property Survey. Quick and Easy Explanation.

Decoding Property Surveys: A Step-by-Step Guide

In this guide, we'll break down the key elements of a survey plan and explain how to use them:

Boundary Lines

The boundary lines on the survey plan show the precise edges of the property. Knowing the exact boundaries is essential to avoid issues with neighbours. In the survey the boundary lines are noted as thicker black lines.

Boundary Measurements

Each boundary line has a direction (bearing) and distance associated with it. These measurements allow you to verify the accuracy of the boundaries and spot any encroachments.

Structures and Setbacks

The survey plan outlines the distances between buildings and structures on the property, as well as the surveyed boundaries. This tells you where you can build or make changes.

Survey Markers

Surveyors use various methods to clearly mark property corners, including setting monuments or measuring from known points. These markers are essential references.

Subdivision Details

The underlying subdivision plan provides historical context about how the property was initially developed and divided.

Land "Parts"

One parcel can be made up of multiple PARTs that are numbered. You can discover the PARTs that make up the one parcel by finding it on the survey or referring to the legal description of the property seen on a real estate listing, offer or GeoWarehouse report.

Title and Description

Additional Plans

Other survey plans may be referenced to provide supplementary boundary information to support the current survey.

By understanding these key elements, you'll be able to easily read and interpret a property survey. Mastering this skill is invaluable for anyone involved in real estate or land transactions.

Brought to you by: Your local Realtor®

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

Not intended to solicit clients under contract

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

Not intended to solicit clients under contract

Tuesday, May 13, 2025

Hiring a Local Agent is Key When Selling/Buying Rural Property

Not everyone can sell rural real estate. Find out what you don’t know.

Brought for you by: Your local Realtor®

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

If you are looking to either Buy or Sell, contact me at 705-927-6236

Brad Sinclair, Sales Representative

Team Lead at The Brad Sinclair Team

Royal Heritage Realty

Your inside source to cottage country

Bancroft Maintenance: Brakes, Business, and Building Bridges-Day in Life as a Local Realtor

Bancroft Maintenance: Brakes, Business, and Building Bridges Tuesday, February 3, 2026 In Bancroft , when the thermometer hits − 1 1 ∘ C a...

-

Is the "Free Ride" Over? Why Charging for the Peterborough Zoo is the Wrong Move If you grew up in or near Peterborough and you f...

-

I saw one of Peterborough's "No More MP Ferreri" signs today. I was surprised; it bothered me. After some thought why it bot...